Central bankers can be too independent

ECB President Christine Lagarde provides a view into central banks pretty much diametrically opposed to Michelle Bowman’s, from my last post.

President Lagarde is the head of the most prominent technocratic organization in Europe. If anybody embodies the vision of the supposedly rational, science- and evidence-based dispassionate technocrat, the head of the ECB is it.

Lagarde:

We’ve all heard it time and again: either we tackle climate change and safeguard nature, or we face the steep price of our inaction. And that price is rising by the day. Just consider the recent flooding in Spain, the droughts in the Amazon basin or the storms in North America. These events are horrific in and of themselves, but they are also ruining the foundations of our economies and, ultimately, the basis of our economic survival.

Climate change is real. Floods are bad. But actual climate science does not establish that floods or droughts are increasing (see below). Even if they are, “ruining the foundations of our economies and, ultimately, the basis of our economic survival” is far beyond anything in actual climate science. (Details below.)

This is three-Pinocchios climate alarmism. By itself, who cares. There are lots of Greta Thunbergs out there, and aspirants to plaudits at Davos. But when the president of the ECB indulges in such fantasy, that undermines the whole conceit of an a-political fact-based technocratic institution, as well as faith in its competence.

Lagarde continues

To stay on track to meet Paris Agreement goals, global annual investment in climate change mitigation designed to help transition our economies have to reach up to USD 11.7 trillion annually by 2035, according to estimates by the United Nations Environment Programme (UNEP). That equals about 10 percent of global economic output. The energy transition alone requires investment in clean energy to triple by 2030. We urgently need to unlock all possible sources of capital, at speed and at scale, and to put in place the regulatory conditions to finance our green future and preserve nature.

So 10 percent of global GDP now, in order to forestall climate change that will cost 5% of GDP (maybe) in 100 years. When GDP has increased by 200% or 600%, depending on your growth forecast. What happened to the mantra that renewables cost less than fossil? When a central banker says “unlock” or “mobilise” capital, watch your wallet. Is capital “locked up” somewhere, immobile?

To be fair, she nods to adaptation:

we must adapt and become more resilient – and we must do so in a manner that is fair and equitable.

Though heaven knows how much more this will cost if it is “fair” and “equitable.”

From Climate to Central Banks

Even if you agree with Lagarde on climate, why is this the job of the central bank?

Climate change and nature degradation are threats to our economies. This is why the European Central Bank and other central banks take them into consideration when working to keep prices stable, banks sound and the financial system safe.

The ECB has a specific mandate:

The primary objective of the European System of Central Banks (hereinafter referred to as ‘the ESCB’) shall be to maintain price stability.

A mandate says what a central bank may not do as much as what it may do. For this reason, the ECB’s justification for climate, as well as bond-buying and other policies, routinely cites price stability and “monetary policy transmission.”

But by what flight of fancy do we get from a slow evolution of the probability distribution of weather to price-level stability? The causal chain must run something like this:

Subsidize EVs, photovoltaics and windmills, hound banks not to invest in fossil fuels → European CO2 emissions are less than they would otherwise be → global temperature rises a few tenths of a degree less than it would otherwise do → frequency of floods and heat waves increases a little less than it otherwise would do, over many decades → price spikes in weather-sensitive commodities are less frequent. All over decades.

ECB Board Member Frank Elderson chimes in:

If you destroy nature, you destroy the economy. To fulfil our mandate of keeping prices stable and banks safe and sound, we must take nature into account, says Executive Board member Frank Elderson at the COP16 biodiversity conference

(He added, succinctly, “we push banks under our supervision to manage all material nature-related risks.”)

He elaborates in a recent speech,

Estimates from ECB staff suggest that the heatwave in 2022 increased overall food price inflation by around 0.6 to 0.7 percentage points, with the impact lasting well into 2023.[5] At these magnitudes, this becomes a risk factor for overall price stability, especially because extreme weather events are becoming both more frequent and longer lasting. This is why, in our recent monetary policy communication, we explicitly acknowledge adverse weather conditions as risk factors for the inflation outlook.[6]

One can quibble. Food is 14% of EU expenditure, so even a 0.7 percentage point rise in food prices is an 0.1 percentage point rise in general prices, and we leave out food and energy prices from core inflation precisely because they are “transitory.” The whole “climate risk to the financial system” as well as “risk to price stability” faces the fact that almost all of a modern economy is indoor manufacturing and services, that are remarkably impervious to weather. Floods are local.

But even so, think what a remarkable statement about monetary policy and technical capacity this vision represents. “Price stability” usually means limiting inflation in the level of all prices. In decades (centuries?) of monetary economics, central banks have been thought control the price level by affecting the money supply, interest rates, or backing via gold. Controlling the price level does not mean controlling individual (relative) prices. (For a refresher on the difference, look here. ) If sectoral shocks threaten inflation, the central bank raises interest rates. The Taylor rule, not climate subsidies, is how central banks control inflation.

Not in this vision. In this vision, the central bank must forecast and interfere in the detailed microeconomics of relative prices, decades from now, to the point of twisting the knobs on the the probability distribution of the weather, in order to achieve “price stability.”

Even with that expansive view of its mission, does the central bank have anything like the technical capacity to do it? Central banks completely missed 10% inflation barreling down the tracks as a result of trillions of fiscal stimulus. Maybe it was too hard to do, and nobody could do it. Maybe it came from “supply shocks,” but those were also visible if you strayed out the front door of the ECB and tried to buy a beer in locked-down Frankfurt. Maybe it was hard to foresee. But if the institution cannot see 10% inflation one year ahead as a result of these large shocks, can anyone really pretend to control the price level by controlling relative prices, decades ahead, by changing the weather?

If managing “price stability” requires the ECB to digest changes in the frequency of Spanish floods, and to manipulate the climate to affect it, then price stability is impossible.

The narrow focus is also suspicious. There are lots of “threats to our economies,” and even to economic survival. Why is the ECB paying attention only to this one, and ignoring the others? Nuclear war threatens economic and physical survival. Is the ECB subsidizing star-wars anti-missile development? (Or maybe disarmament conferences? I don’t want to prejudice the answer here.) A conventional attack from Russia is not inconceivable. Is the ECB “mobilizing” capital to bolster Europe’s conventional defenses? We just had a mild (by historical standards, see 1350) pandemic, which had major economic and health effects. Many more businesses were in financial distress due to the pandemic than ever would be in distress due to floods. A new, perhaps biotech engineered pandemic is a huge threat to the economy and financial system. Via supply shocks (if you buy that) or by induced stimulus, the pandemic clearly had something to do with 10% inflation. Is the ECB demanding pandemic or lockdown stress disclosures? Deindustrialization, including Germany’s abandonment of nuclear power, surely threatens its economy. Where is the ECB? Europe faces a fiscal, depopulation, and degrowth time bomb. Worrying about risks to the economy and to price stability over 100 years, fertility half of replacement rate ought to rank up there with climate. Who will pay taxes to fund social programs and pay off debt? Is the ECB holding banks about sovereign debt exposure as it is climate investments?

In my last post, I celebrated Fed governor Michelle Bowman’s principle that policy should be made by first defining the question, and then figuring out the best answer. The ECB’s policy is clearly the opposite, an answer—subsidize late 2010s climate policies (i.e. windmills, photovoltaics, and EVs but not nuclear, geoengineering, etc.) — in search of a question appropriate for a central bank. If you ask the question first—what are the existential threats to the economy, and what are the threats to medium term (4 years or so) price stability—changes in the probability distribution of the weather don’t make the top 10, and the ECB’s climate actions don’t answer them.

It’s time to say this emperor has no clothes. The ECB’s climate policy has nothing to do with price stability. It has nothing to do with a dispassionate evaluation of economic risks. Even if it is desirable, even if current climate policies focusing on regulation and subsides are the most cost-efficient and effective ways to go, it’s not the ECB’s job.

There are only two possibilities. Either the ECB believes all this stuff, in which case it has gone seriously off track on how monetary policy and the economy work. Or, the ECB has assigned itself the task of pushing particular climate policies, and “price stability” is just a fig leaf to jam this in to its mandate. Neither is auspicious for its future.

Europe is waking up to just how disastrous its climate policies have been — how they produce next to no carbon emissions at tremendous cost. When Europe changes its mind, the blowback for the ECB will be very damaging. I like the ECB, and I like the euro. It will be a shame to see this institution so tarnished by a political crusade.

Central banks can be too independent! The ECB president serves for a single 8 year term. If she decides the ECB’s job is to subsidize windmills — or if the next one decides to subsidize coal — there is not much the EU can do about it. The US system may balance independence and accountability a little bit better.

Another Mandate?

The ECB mandate in fact extends past price stability

Without prejudice to the objective of price stability, the ESCB shall support the general economic policies in the Union with a view to contributing to the achievement of the objectives of the Union as laid down in Article 3 of the Treaty on European Union. The ESCB shall act in accordance with the principle of an open market economy with free competition, favouring an efficient allocation of resources, and in compliance with the principles set out in Article 119.

The ECB could defend its carbon policies as supporting “general economic policies in the Union” (note “in” not “of”) clause. Most EU countries are, for now, following a standard set of policies including regulation, alternative subsidies, and reducing fossil fuels. The ECB could easily say, “We can control the price level just fine with interest rates, quantitative easing, forward guidance and other standard macroeconomic tools. So we can support EU energy and climate policies without any effect on price stability. Here come the regulations and subsidies.”

I am puzzled why it does not follow this approach. Perhaps the ECB suspects that the climate related economic policies may be about to change. Perhaps the “objectives of the Union as laid down in Article 3” are not consistent with climate policies. Perhaps the ECB views that “shall act in accordance with the principle of an open market economy with free competition, favouring an efficient allocation of resources,” is too constraining for its climate policies.

Climate, price stability and relative prices

ECB board member Frank Elderson fleshed out the climate and price stability link in a recent speech,

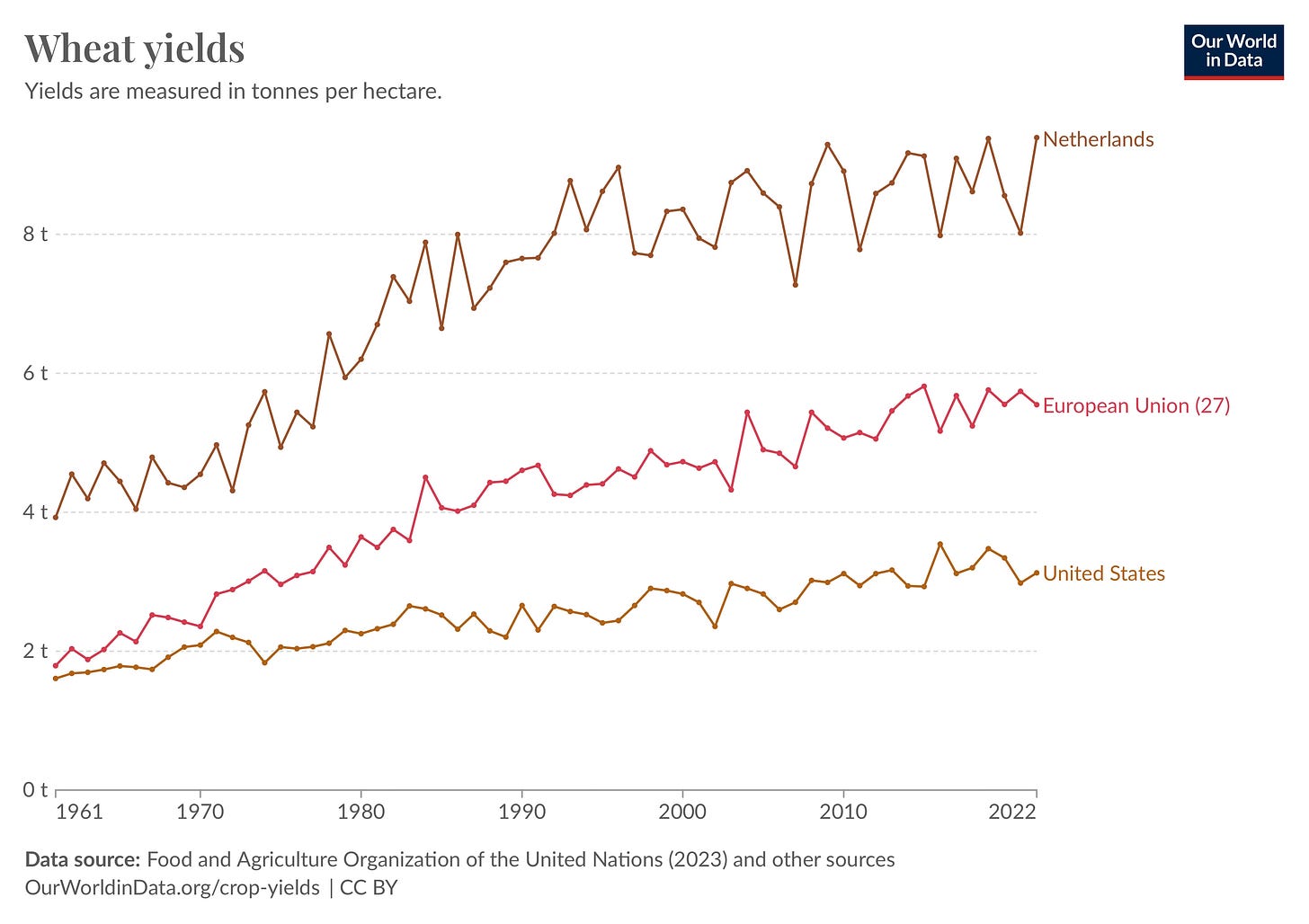

In addition to climate and nature hazards reducing the stock of natural and physical capital, the economic yield of this capital is also adversely affected. To take just one example, crop yields have fallen because of more frequent extreme weather events.

That must sound so good sitting around the ECB lunch table that nobody needs to check the facts:

One year of bad weather is not climate change.

His understanding of price level vs. relative price change is a bit more nuanced than what I described. Elderson:

Labour scarcity, global warming and geopolitical tensions, all pressed into the price of your morning espresso – or freddo espresso, as I understand is very popular in Cyprus.

Clearly, at the ECB it is not our statutory responsibility to maintain stable prices of individual products such as your morning coffee. But we are responsible for maintaining overall price stability in the euro area. This means that we are responsible for anchoring the change in the overall level of consumer prices over the medium term, and the price of coffee is a very small part of that. The broader trends that are affecting the price of your cup of coffee are also threats to our price stability objective. These threats will cause bottlenecks that will test the resilience of the economy even more rigorously than before. So we are paying very close attention to them as they represent risk factors for medium-term inflation in the euro area.

So he starts well on saying that the ECB’s job is the price level not relative prices. But then he thoroughly confuses them. The price level is not the sum of a hundred relative prices.

Climate at the ECB

I found a whole “climate change at the ECB” section of its website.

They’re right up front about it. Channeling investment (“creating incentives”) and political advocacy. “Within our mandate” is a mantra at the ECB, though seldom explaining how.

The website for once does offer a bit of an explanation.

The former of course just repeats the price stability nonsense. The latter is the one time I have seen the “support the general economic policies” invoked. It makes silence on that issue more puzzling. And the ECB does not cite particular economic policies that it is supporting.

Droughts and Floods

President Lagarde didn’t cite any facts for her statement that floods and droughts are “ruining the foundations of our economies and, ultimately, the basis of our economic survival.” Bjorn Lomborg summarizes the science, in Technological Forecasting and Social Change. He takes most of his facts from IPCC reports, which nobody can accuse of denialism.

Arguments for devastation typically claim that extreme weather (like droughts, floods, wildfires, and hurricanes) is already worsening because of climate change. This is mostly misleading and inconsistent with the IPCC literature. For instance, the IPCC finds no trend for global hurricane frequency and has low confidence in attribution of changes to human activity, while the US has not seen an increase in landfalling hurricanes since 1900. Global death risk from extreme weather has declined 99% over 100 years and global costs have declined 26% over the last 28 years…

Climate-economic research shows that the total cost from untreated climate change is negative but moderate, likely equivalent to a 3.6% reduction in total GDP.

in 100 years, by which time if the Europeans don’t kill growth, their GDP will have grown by several multiples.

… the IPCC concludes “there is low confidence in attributing changes in drought over global land areas since the mid-20th century to human influence” (IPCC 2013a, 871). …. The IPCC repudiated previous findings from 2007, saying our “conclusions regarding global increasing trends in droughts since the 1970s are no longer supported” (IPCC 2013a, 44). ….

… Fig. 9 shows the global area under severe meteorological drought for 1901–2017, showing no increase over the last 116 years.

On flooding,

“There continues to be a lack of evidence and thus low confidence regarding the sign of trend in the magnitude and/or frequency of floods on a global scale over the instrumental record” (IPCC 2013a, 112, 214). The USGCRP summarizes the IPCC to say they “did not attribute changes in flooding to anthropogenic influence nor report detectable changes in flooding magnitude, duration, or frequency” (USGCRP 2017, 240). Flooding in the US has increased for some areas (the upper Mississippi River valley) and decreased for others (Northwest). However, “formal attribution approaches have not established a significant connection of increased riverine flooding to human-induced climate change” (USGCRP 2017, 231). The new IPCC 1.5°C report finds that “streamflow trends since 1950 are not statistically significant in most of the world's largest rivers” and that more streamflows are decreasing than increasing (IPCC 2018, 201)

…it is simply unwarranted to posit current flooding as an example of impacts from climate change. Even in the future, this is much more strongly influenced by other human impacts like river management and extensive building on floodplains than climate change. A recent study points out that “despite widespread claims by the climate community that if precipitation extremes increase, floods must also,” it actually seems like “flood magnitudes are decreasing” (Sharma et al., 2018).

Where flood damage is increasing, Lomborg explains the “expanding bull’s eye effect.” We build more in floodpxone areas, so the same flood costs more.

We could start by not subsidizing construction in flood-prone areas!

An anecdote: Florence’s 1966 flood, about 14 BC (Before Climate) was awful

But as you walk around that lovely city, you will notice markers of previous floods. The Arno has a major flood about every 100 years.

Not good. But Florence seems to be “surviving.” With the usual speed, plans are under discussion to protect the city. (A nice overview.) On the other hand, various plans have been bandied about for centuries, including by Leonardo da Vinci and Michelangelo. Maybe a little climate-change hysteria will get things done this time.

No, floods do not threaten our “economic survival.”

Leaving the economics argument aside, I think Mr. Cochrane is misguided to interpret the development of the ECB's green agenda as an abuse of its independence.

Indeed, the ECB’s move towards climate change (which started under Draghi in 2018 with the ECB joining the NGFS) has been constantly supported by the European Parliament.

It is indeed a little known fact that every year, the European Parliament adopts an advisory resolution on the ECB activities. For a few years already, this report usually dedicates a section on the ECB’s secondary objectives and climate change, which thus de facto indicates political preferences on the ECB’s mandate “to support the general economic policies in the EU”.

For example, here is what the EU Parliament said in 2020, under the leadership of a German right-wing MEP Sven Simon (and which was approved by 85.47% of MEPs)

“19. [The European Parliament] notes, respecting the independence of the ECB, the impact of climate change on inflation dynamics and transmission risks in monetary policy; recalls the impact of the ECB in maintaining price stability; recalls that the ECB, as a European institution, is bound by the Paris Agreement;

20. Takes note of President Lagarde’s commitment to examine climate-friendly changes to ECB’s operations and ‘to explore every avenue available in order to combat climate change’; calls on the ECB to align its collateral framework with climate change-related risks and to disclose its level of alignment with the Paris Agreement, as well as examining such alignment in the banking sector;

21. Calls for a proactive and qualitative risk management approach which integrates climate change-related systemic risks;

22. Welcomes the fact that the purchases of green bonds and their share of the ECB’s portfolio continue to increase;

23. Encourages efforts to increase research capabilities regarding the impact of climate change on financial stability and the euro area;”

https://www.europarl.europa.eu/doceo/document/TA-9-2021-0039_EN.pdf

As far as I can remember from the last 10 years of my work in Brussels, the EU Parliament resolution has never suggested anything related to subsidizing military efforts, or demographics. So in comparative terms, it is clear that there is a political backup behind the ECB's green agenda.

Even though it is very independent, the ECB does not operate in a complete political vacuum…

John Cochrane says it brilliantly. Wondering just how much navel gazing Europeans are going to do is the question in economics, energy, immigration, and alliances.

Perhaps all will become clear to them when the Russians are marching down the main street in Brussels.