Inflation Confusion

“Why Inflation Is Biden’s Most Stubborn Political Problem” by Andrew Restuccia and Sam Goldfarb at WSJ was one of those coffee-spilling articles that gave Grumpy his nickname. Not the article, which was well written, but the contents. In response to rising inflation,

Biden and his senior aides aren’t planning any major policy or rhetorical shifts. They plan to continue talking about the president’s proposals to lower the cost of housing and prescription drugs, while slashing student-loan debt and eliminating surcharges tacked on to everything from concert tickets to banking services.

The most simple and pleasurable lessons of economics show you how common ideas are precisely wrong. Econ 101: Don’t confuse relative prices — one price greater than another, and the forces that push one price up relative to others — with inflation, the rise in the average level of all prices. Inflation is really about a decline in the value of money. Trying to change individual prices is a classic game of whac-a-mole.

Econ 101 week 2. During inflation, many people’s wages don’t rise as fast as prices. Giving them borrowed or printed money to make up the loss, and buy things at higher prices is another common idea. In week 2 we learn it just makes inflation worse.

These basic points seem to have escaped an entire administration, though it has been facing inflation for four years and had plenty of time to think about it.

The White House … issuing a statement from the president that acknowledged the federal government has “more to do to lower costs for hardworking families.”

“Our agenda to lower costs on behalf of working families is as urgent today as it was yesterday,” said Jared Bernstein, the chair of the White House Council of Economic Advisers. “We’re just going to keep our heads down and continue fighting to lower costs.”

One might forgive a flailing White House political staff for deliberately spinning unrealities in an election year, but CEA chairs should understand the difference between inflation and relative prices, and that one does not “lower costs” in individual markets to fight inflation. CEA chairs are also supposed to do a little bit better than repeat spin from the political crowd in the White House.

And not just the CEA. The vast majority of American Economics Association members are Democrats. Surely the White House and CEA have somebody who vaguely understands what we expect the dimmest of undergraduates to get?

The president has called on grocery retailers and other companies to lower prices, citing their high profits. But he can’t compel companies to take action.

In the 1960s, this was called “jawboning,” fighting inflation by applying political pressure to companies not to raise prices. Relative prices, since of course their costs are no lower. Just where is the difference supposed to come from? One would think the state of the art had improved.

He can indeed compel companies to take action. Nixon, after trying lots of jawboning, imposed price controls. They follows from the same basic misunderstandings.

They want to “lower costs,” they say. But not the costs imposed by Trump-era tariffs, which they seem to like. Indeed, in a remarkable story, Treasury Secretary Janet Yellen just went to China to abjure her previous understanding of free trade, and threaten even more tariffs. Lower costs, yes, but not if that means buying $15,000 Chinese electric cars instead of $100,000 (including subsidies) US ones, made in the US, with US union labor, US parts, and a slew of federal mandates. Lower costs, yes, but not if that means buying Chinese solar panels. Lower costs, yes, but not if that means eliminating the mass of cost-raising regulations this administration has imposed, let alone the pre-existing morass.

Economists say trillions of dollars in spending approved by Trump and Biden cushioned the economy during the early months of the pandemic, then sped its recovery. Still, when the economy began to reopen in 2021, that demand collided with labor shortages and supply-chain bottlenecks to fuel inflation.

I’m glad “economists” are catching up to the obvious.

there isn’t a whole lot the White House can do to fix it.

Behind the scenes, administration officials said there was no magic bullet to slow rising prices immediately,...

Most economists don’t believe Biden can do much at this point to bring down inflation, absent major tax increases or spending cuts that could curtail consumer spending. Even those policies, which aren’t being seriously considered in Washington, would take time to work their way through the economy.

Nothing one can do? We have, now admittedly, a deficit fueled inflation. One could start by not pouring more gas on the fire. Such as cancelling billions of student loan debt, never mind the Supreme Court and the quaint idea that Congress votes spending. The CBO reports “The deficit totals $1.6 trillion in fiscal year 2024, grows to $1.8 trillion in 2025, …” with a 3.8% unemployment rate. Even in the simpleminded Keynesian economics that dominates left-of center Washington, there is no excuse for such stimulus.

There’s nothing we can do except the one thing that we all know would work. So we’ll rearrange the teacups on the side tables of the deck chairs of the Titanic instead. Which means nothing we want to do.

The quote here reflects the standard Keynesian view, deficit = aggregate demand = inflation with a lag. But we’re pretty clearly now in the situation that expected systemic deficits are the problem. Germany stopped a hyperinflation in a month. A credible announcement of spending, tax, and growth reforms that put the budget on a sustainable track would do the job. Scaling back the IRA, Chips, student debt river in recognition of inflation would help a lot more than complaining about how many potato chips are in a bag. Even just saying we recognize that’s needed would help.

Biden’s advisers have reviewed polling that shows criticism of Republicans for cutting taxes on wealthy Americans and corporations resonates with voters, and they intend to step up such an attack in the coming days and weeks.

Aha, now we see the central problem. Economic policy is being driven by what polling suggests “resonates with voters.” Not, for example, what basic economics suggests might actually work.

“We’re better-situated than we were when we took office, when inflation was skyrocketing, and we have a plan to deal with it,” Biden said during a press conference at the White House. “They have no plan. Our plan is one that I think is still sustainable.”

Three Pinocchios:

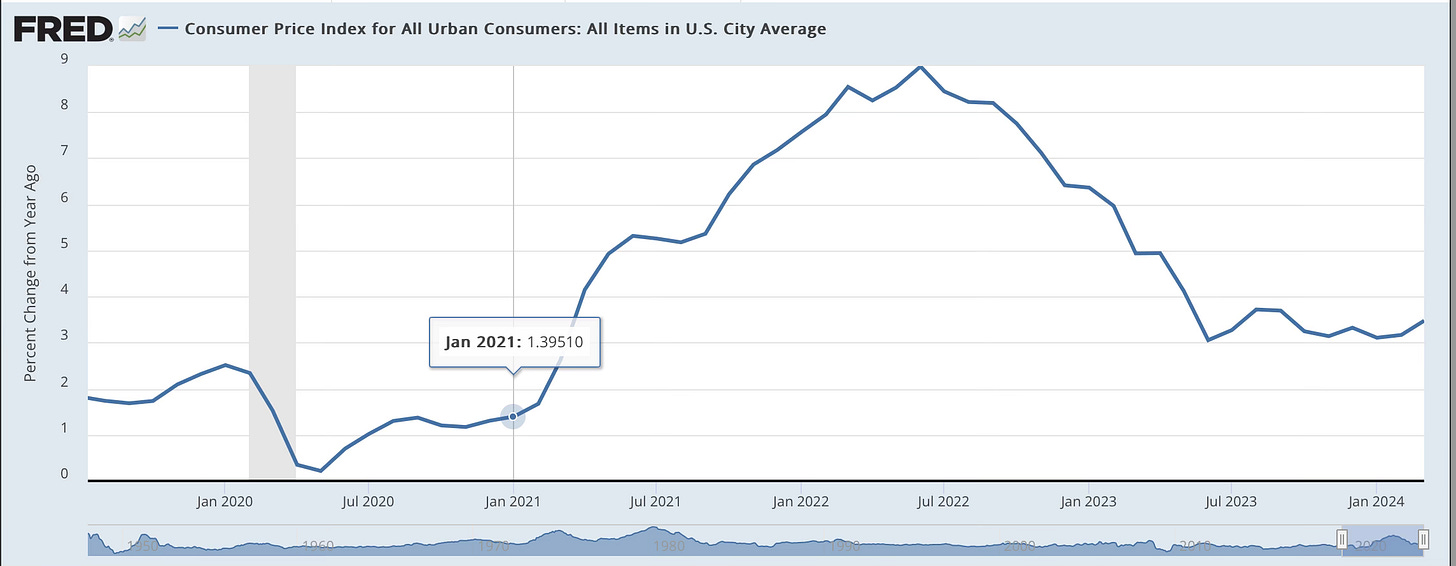

For all of the excess stimulus under Trump, the fact is that inflation broke out precisely in February 2021, and not a minute beforehand. If you want an event, the Feb 2021 “American Rescue” act, with a few trillions more stimulus though the pandemic was clearly over, made clear that this administration was not going back to standard fiscal policy.

Whether Trump has a “plan” is a good question. But if Biden the “plan” is more jawboning and complaining about junk fees, I doubt that’s going to convince anyone.

This dishonesty, this pandering to polls with no principles, this constant vacillation, this willingness to say utterly silly things as if we’re all small children, might have something to do with the Administration’s terrible poll numbers. Maybe honest, consistent leadership might poll better than telling fairly tales and handing out candy.

Thank-you for explaining, once again, what the root cause of inflation. As an old retired sailor, even I can grasp the idea that throwing money around will not fix the inflation problem. I do have a question, why is there no attempt at balancing the budget?

What are the chances that even the WSJ is suffering more and more from the bias in the quasi-neo-Marxist journalistic education system? I seem to note an increasing number or articles that seem to have a slant (many about how bad musk is) or deny economic reality to support social justice (climate, racism, etc.)?