Hoover Monetary Policy Conference, with Videos

The videos from the May 3 Hoover Monetary Policy Conference are now up on the conference website, here, along with slides. A short summary, to entice you:

Europe:

Klaus Masuch and Luis Garicano spoke of the fiscal foundations of the euro, structures put in place to avoid the temptation to print money to finance government debts, how those structures weakened through the series of crises, and how to reform the euro to reinstitute an insulation of monetary from fiscal policy. (Disclosure, based on a book we are writing together, here.)

Markus Brunnermeier discussed digital central bank currencies, in particular the euro. Among other issues, he highlighted the tension between private systems, which like to print money but care less about resilience, and public systems that may be less efficient and more political.

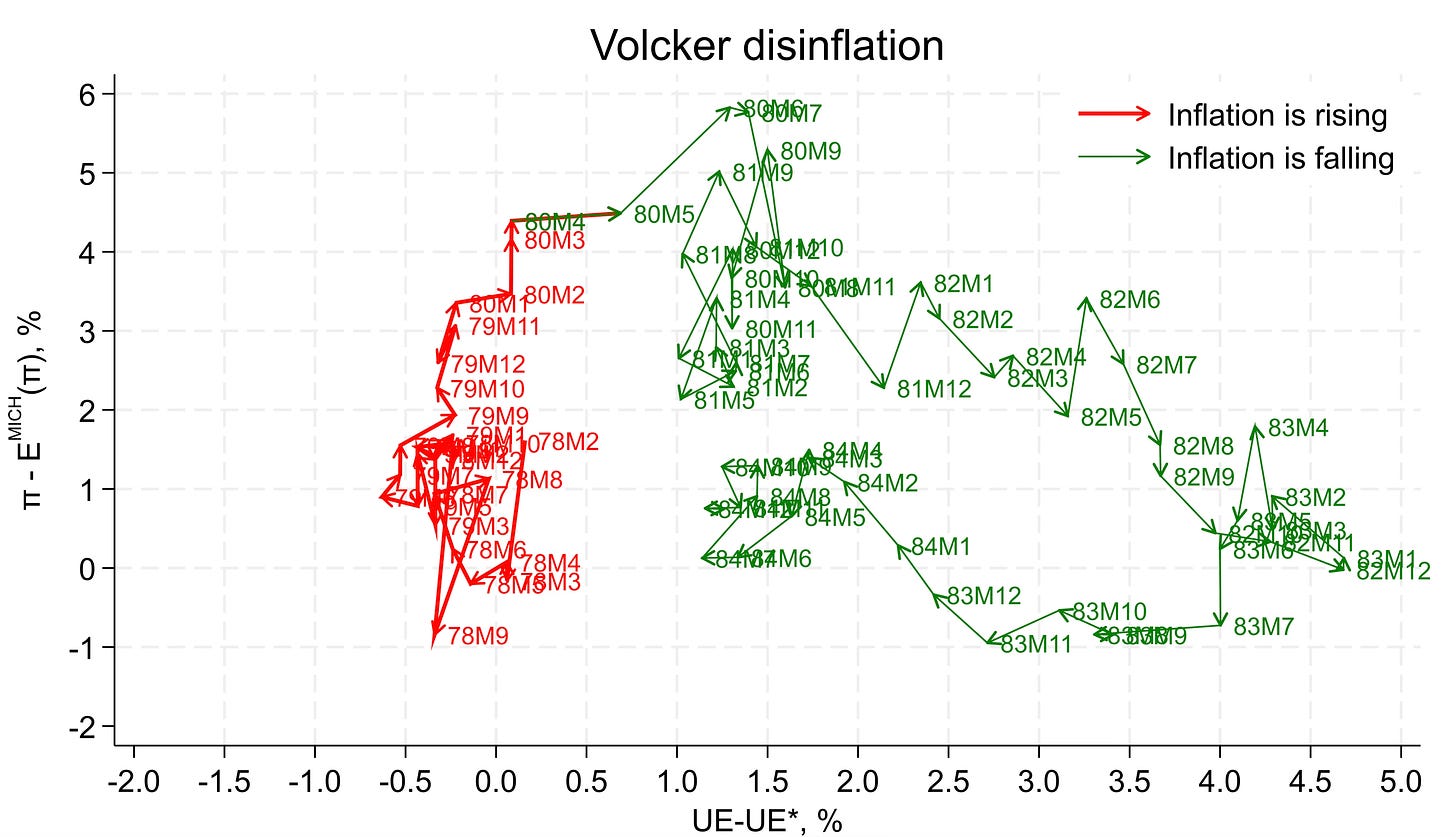

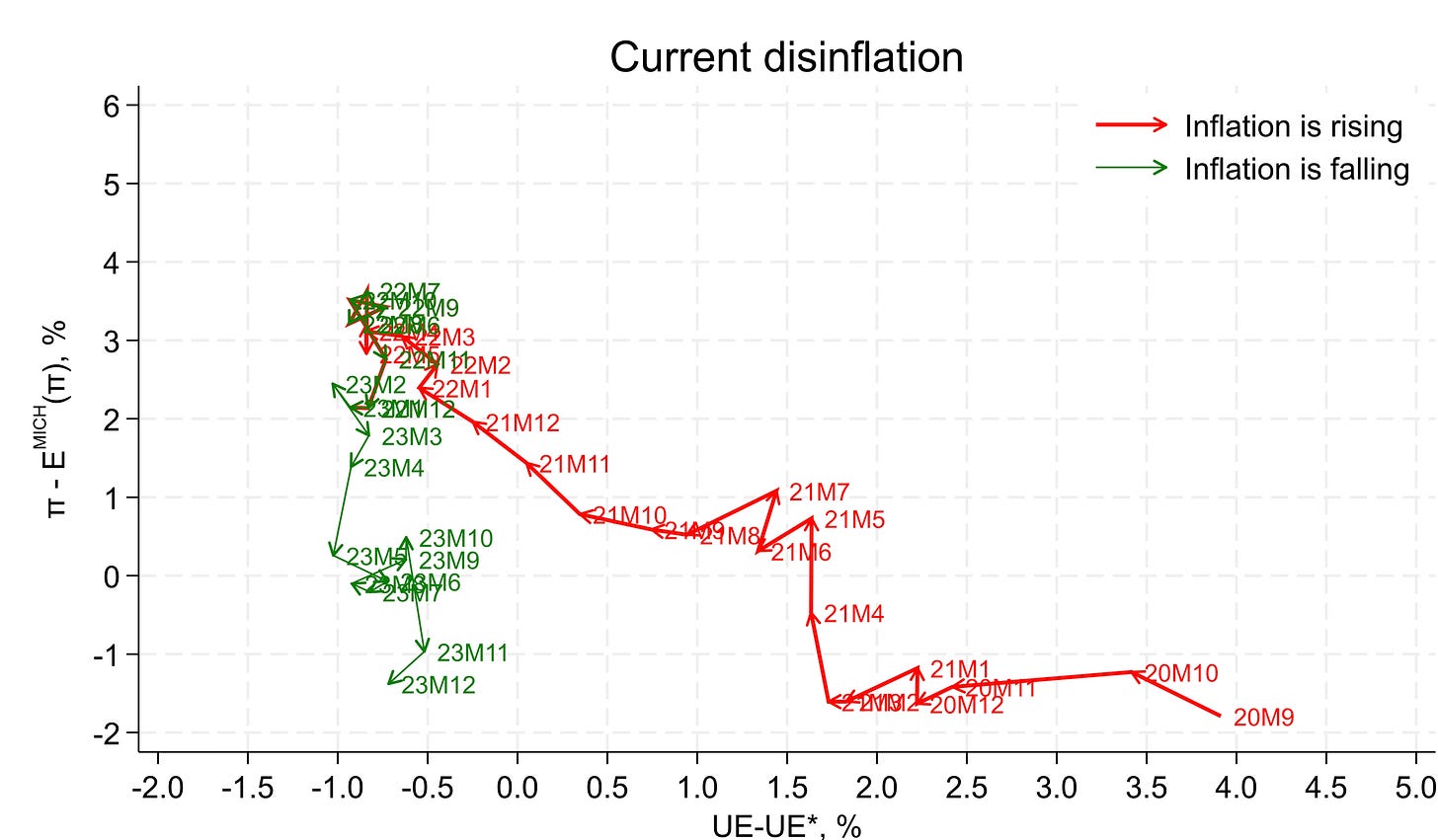

Yuriy Gorodnichenko noted how inflation is declining in Europe, with no rise in unemployment. The current disinflation is the opposite of the Volcker one:

Looking forward, however, Gorodnichenko pointed to strained public finances, commodity shocks, war, and international decoupling that could hurt economic performance and bring inflation back.

Lugi Bocola also considered the fiscal limits on monetary policy in the euro. On how did inflation emerge, he showed clever asset-market estimates of monetary policy rules that the Fed and ECB became much more dovish in 2020. Both central banks may be afraid to raise rates that would hurt banks and government finances.

Global:

Emilio Ocampo detailed the structural and political problems in Argentina that lead perpetually to such bad policy.

Juan Pablo Nicolini gave a snapshot of Latin American inflation history broadly. Many countries moved from habitual inflation to much better control in recent decades.

Zhiguo He gave an overview of monetary policy in China. The central bank is not independent, and is also charged with broader support of economic policy.

Ross Levine gave an overview of inflation and central bank actions in emerging markets. He questioned some of the premises for independent central banks. The link from tools (interest rates) to inflation is vague. Most of all, it is not at all clear that financial regulation should be part of an independent institution unlike all other regulatory agencies.

Regulation:

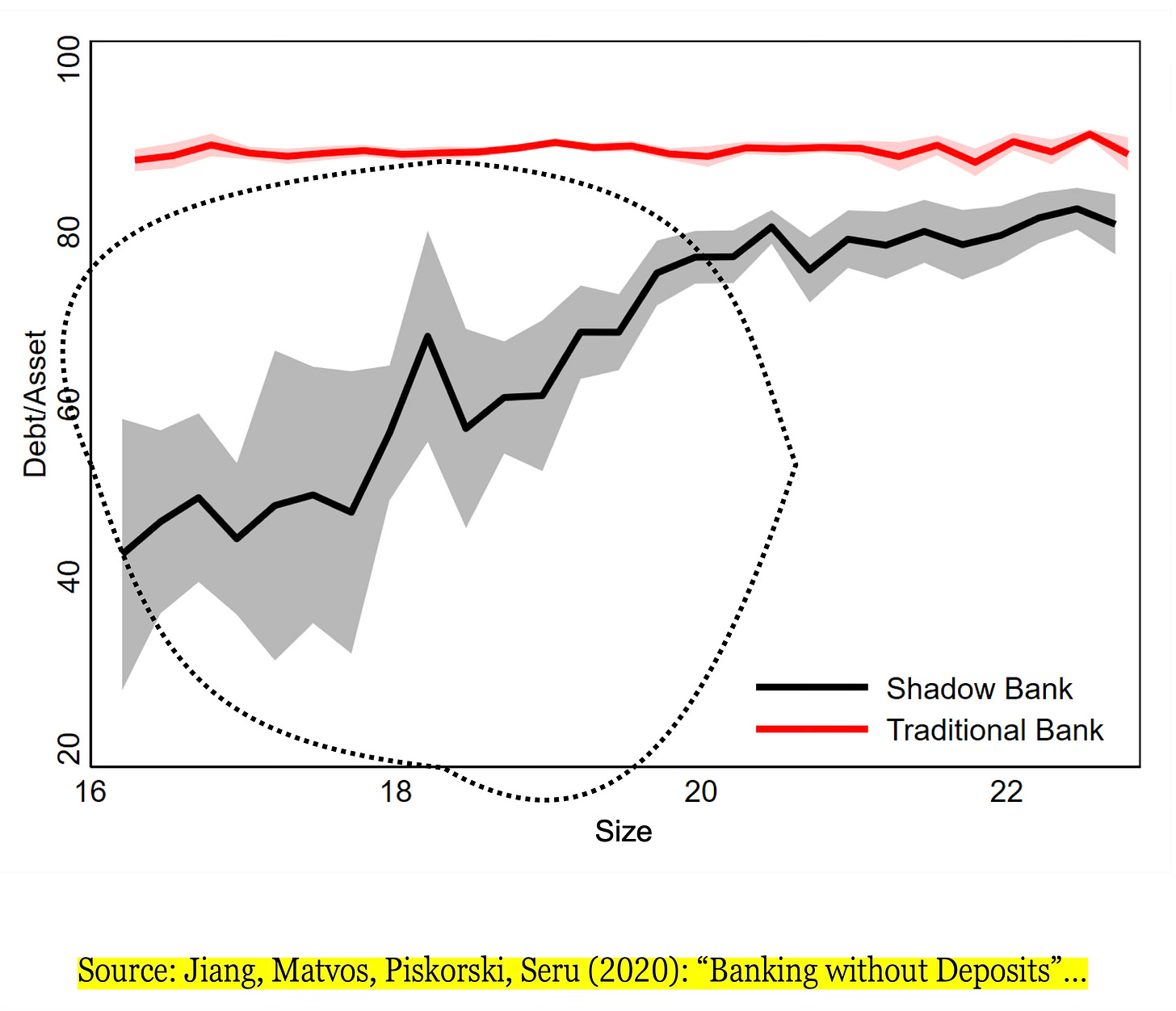

Amit Seru gave the clearest condensed version of about 5 academic papers on banking I’ve ever seen! The whole US banking system looks a lot more like Silicon Valley Bank than you should be comfortable with — mark to market losses, negative mark to market equity, uninsured deposits. In the switch between state and local regulators, you can see lots of discretion at work. Unregulated and not (yet) too big to fail shadow banks voluntarily fund themselves with lots more equity than government protected banks. So much for banking requires massive leverage.

Darrel Duffie gave an overview of how treasury markets suffered turmoil, and some of the structural and regulatory causes of that turmoil, along with recommendations to fix that market.

Christina Skinner focused on the foundations of bank regulation by an independent Fed without the accountability of most regulatory agencies. She noted that Financial Stability” and “Safety and Soundness” are undefined, and thus open to expansive interpretation; policy is closely aligned with global policy set at Basel, which has no democratic input from Congress. She also noted the great power vested in the Vice Chair.

Carolyn Wilkins covered the Bank of England’s actions when over-leveraged pension funds melted down as interest rates rose, and how the bank sold securities for monetary policy actions while buying them to prop up the funds’ asset values and stem the crisis.

Lunch

Hester Pierce gave a rousing talk on SEC regulatory expansion, listing many examples from the humorous – the SEC’s move to make Stoner Cats a security – to the serious, such as new rules to regulate fund advisers. She stressed how the SEC is moving from rules of the game to “prudential” or supervisory regulation, directly controlling how people invest.

Employment

Steve Davis covered the work-from-home trend, showing how it is increasing employee satisfaction, and also allowing somewhat lower wages as workers and employees split the benefits.

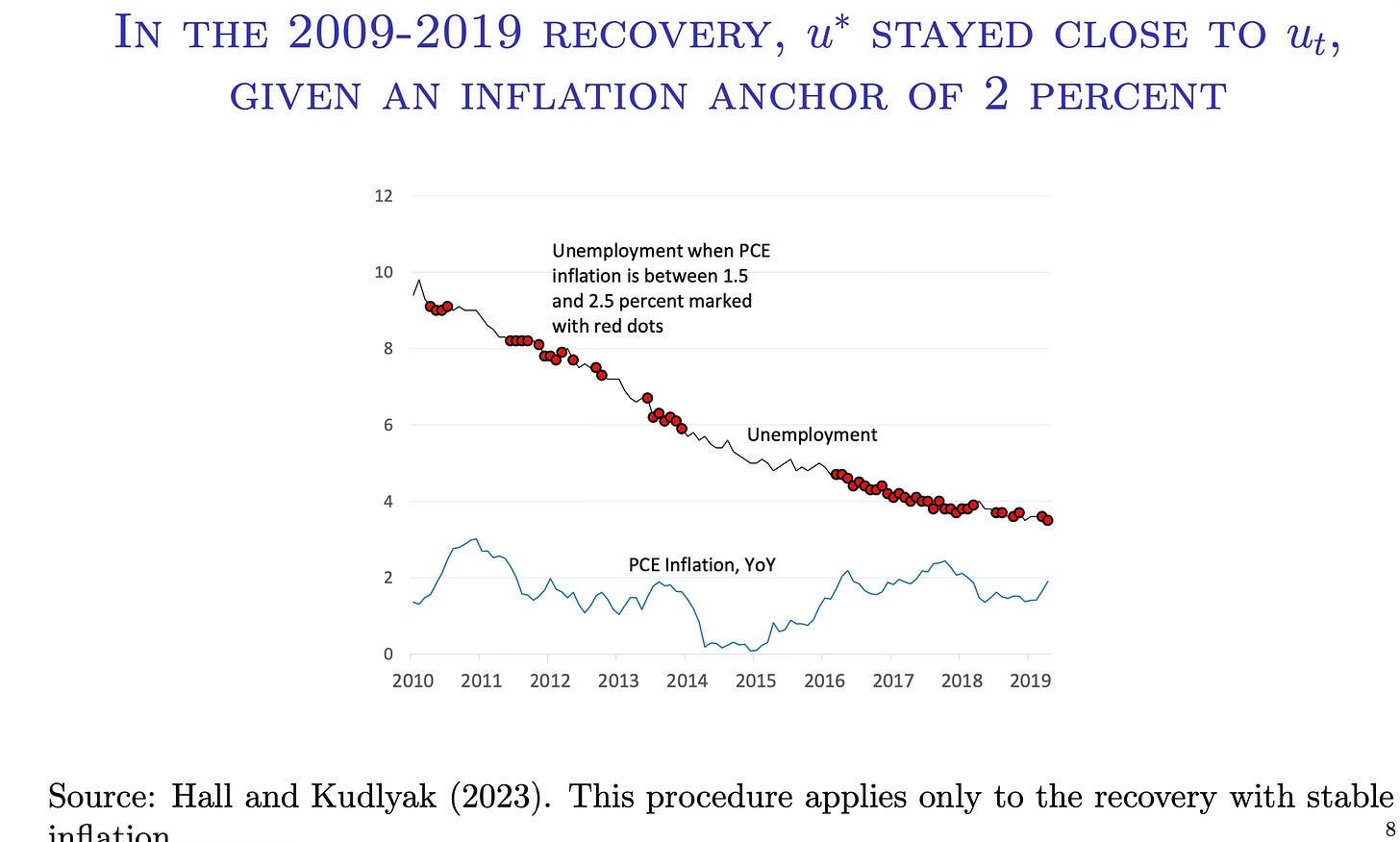

Marianna Kudlyiak presented her research with Bob Hall arguing that the slow decline in unemployment characteristic of most recoveries does not represent “lack of demand” remediable by more stimulus, but the slow search and matching process of normal labor markets. At a minimum, writing a Phillips curve as inflation = expected inflation + constant*excess unemployment, when inflation sits at 2%, you infer that there is no “excess unemployment.”

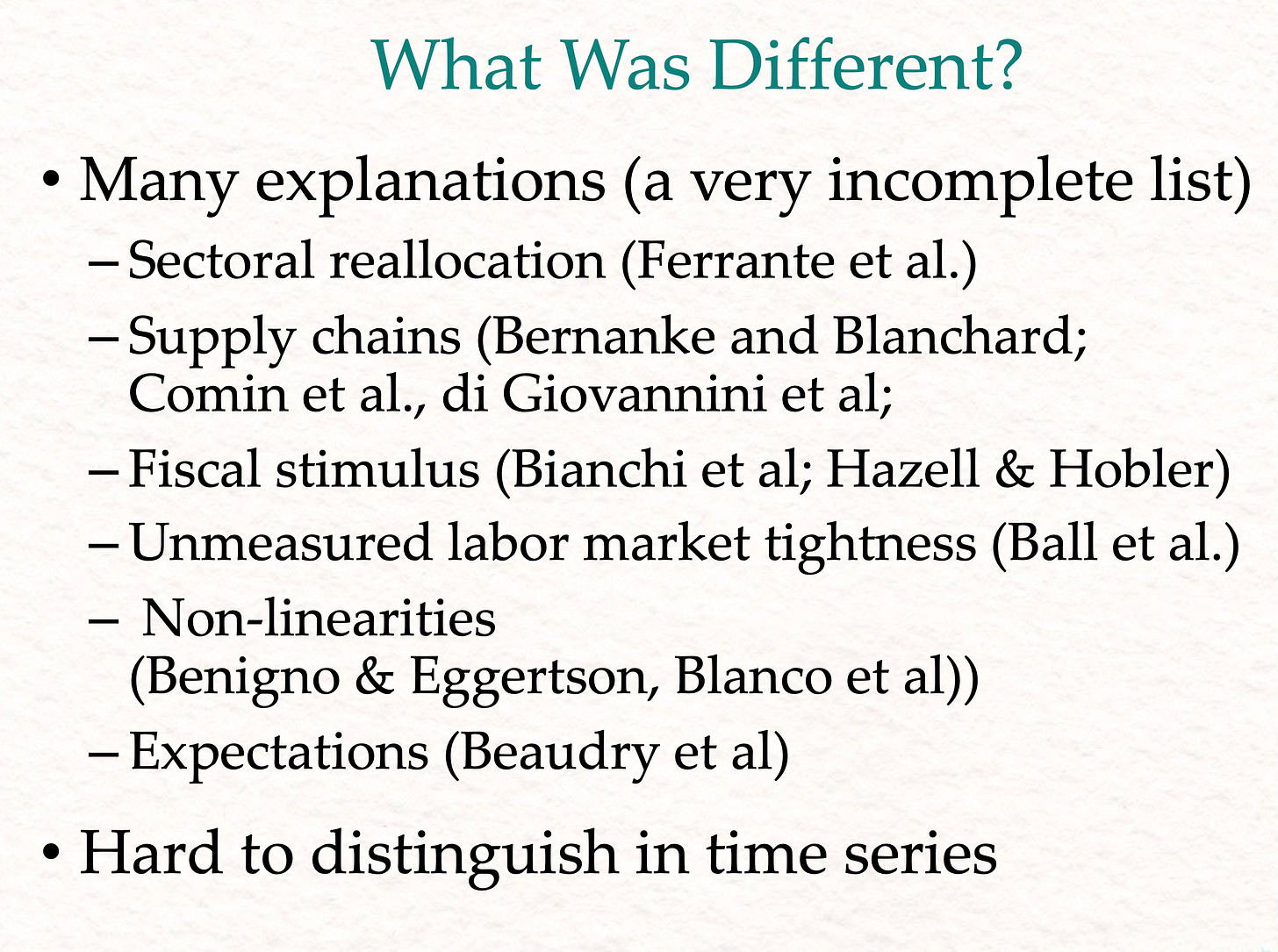

Emi Nakamura presented research on the Phillips curve, the relation between inflation and unemployment. It moves around a lot, and forecasts are systematically wrong. She gave a great overview of all the theories surrounding where inflation came from in 2021. (I of course like fiscal theory!)

Strategy reviews

(Previous post with my comments)

Athanasios Orphanides described how interest rates deviated from most rules, and advocated improvements in how policy rules could be better integrated into the policy process to avoid a repetition of the mistake.

Mickey Levy and Charlie Plosser also reviewed how the current strategy went wrong in the post-pandemic inflation. They argue for greater commitment to the 2% target, rules as guidelines, abandoning forward guidance as a separate tool, benchmark more closely to rules, and improve the economic projections.

Jon Steinsson emphasized supply, fiscal, and relative demand shocks of the pandemic, and how a strategy focused on the worry that inflation was 1.7% rather than 2% at the zero bound led to too-loose policy. He emphasized the importance of anchoring expectations, and that adherence to rules is only one way to achieve credibility.

Summers offered a clear but dissenting view, arguing against formal targets or rules at all, that projections and forward guidance are unhelpful.

Maybe it’s just because I was sitting at the front, but this panel stood out. As I wrote my comments, I realized wow, what we need in a new strategy to replace flexible average inflation targeting is getting mighty complicated. Distinguishing supply from demand shocks from fiscal shocks, dealing with crises, zero bound vs. regular policy, changes in the financial system, fiscal and financial dominance, needing to think about contingencies not forecasts, stress testing monetary policy … how do you write this all down? The other panelists thought hard about all these issues, coming to somewhat different answers.

Then Larry stepped up. He had prepared remarks on a totally different topic, the long term natural rate where he thinks the fed is wrong. He listened, he took notes, he thought, then delivered an out-of-the park clear conclusion from everything we had said. Give up on all this complex strategizing. If you listen to nothing else, Larry’s talk is fantastic.

Return to humility. There is a huge shock once a decade. That’s the central problem, and you can’t write rules for it. The economics profession has little consensus, we don’t know how the black box works. Avoid making specific forecasts, tying yourself to the forecast, or tying yourself to rules. State

general values. “Whatever it takes.” “A strong dollar is in the national interest.”

No forward guidance in normal contexts. Markets don’t believe it, but it constrains the Fed later.

No QE except when necessary to maintain market functioning and liquidity (as Duffie describes). QE shortened maturity structure and cost the US half a trillion dollars. One integrated debt management policy

No cacophony. Stop publishing minutes of deliberations, giving competing speeches about what to do. “No observable benefit” in terms of volatility, predictability.

No specific numerical targets. Larry prefers sometimes to have 1%, sometimes 3%. Credibility came from the social consensus that low inflation is good, and the credibility of Volker, Greenspan.

I’m not totally convince that the Fed should go so far as to give up even stating a long run goal — 2% inflation, 0% inflation, price level. Perhaps Fed chair Larry might be happy with that if he could say “but we’re going to run hot/cold for the next few years.” But on the rest, he at least stated a clear, compelling, and very out of the box view.

Policy Panel

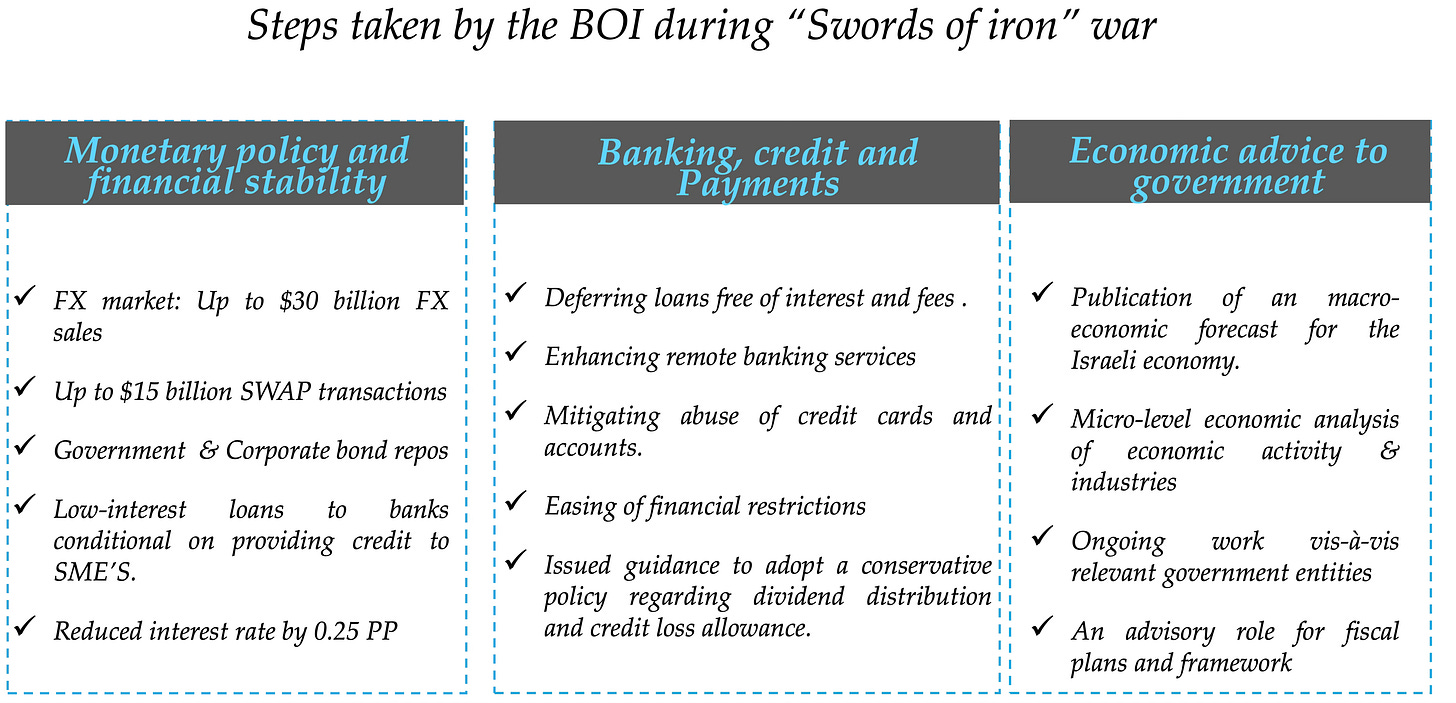

Amir Yaron explained how the central bank of Israel handled the huge financial shocks of the October 7 attack and subsequent war, perhaps emphasizing Larry’s point.

Having a large part of the labor force off to war, and others forced to leave their homes is a big negative supply shock. He went on to discuss how small open economies must think about exchange rates in their policy strategies.

Austan Goolsbee discussed how to improve the statement of economic projections, in particular by linking FOMC members’ inflation, employment, and interest rate projections together so people could understand the economic reasoning behind them.

John Williams gave an overview of how central banks have evolved, focusing on rules, transparency, attention to expectations and thus the central bank’s commitment to eventually reach its inflation target, even if there are bumps along the way.

Dinner

Based on volumes 1 and 2 of his outstanding intellectual biography of Milton Friedman, Ed Nelson gave a history of how Milton Friedman and other commentators approached the inflation of the late 1970s, a period in some ways eerily similar to the current moment. Friedman saw the inflation coming, which many others did not, and of course argued for better monetary policy to contain it. So many of the arguments of the time are still around, especially the many excuses for inflation other than monetary and fiscal policy!

I’m looking forward to May 2 2025!