Expectations and the Neutrality of Interest Rates, again

I finished a major revision of “Expectations and the Neutrality of Interest Rates,” partly accounting for my silence of late. It’s part of a set of essays that seem to have sprung up lately, thinking in really simple terms how the Fiscal Theory of the Price Level works, how it compares to standard theories, and how it accounts for events. They’re all here. “Fiscal Narratives” and “Fiscal Histories” are the most important.

The challenge: we need a theory of inflation based on interest rate targets. MV=PY cannot determine the price level when central banks do not control the money supply. Our central banks set interest rate targets. It does no good to repeat that they should set money supplies. They don’t.

I survey the central theories of inflation under interest rate targets. They differ in how they think of expectations, primarily in setting prices. If a business thinks prices will be higher next month, they raise prices now. So, how they think about future prices is key to inflation.

The standard view in policy circles holds that higher interest rates lower aggregate demand, which lowers output and employment, and through the Phillips curve lowers inflation. In this view, the economy is fundamentally unstable. If central banks do not promptly raise interest rates more than one for one with inflation, inflation or deflation will spiral away. This view is fundamentally based on backward-looking expectations. People assume past inflation will persist in the future.

The new-Keynesian view which has dominated macroeconomics for 30 years posits “rational,” or forward-looking expectations. This change has a profound effect: in these models the economy is now stable. Even if the Fed does nothing to interest rates, inflation will fade away on its own. But in this model, the economy on its own is indeterminate, it has “multiple equilibria,” the model doesn’t completely pin down inflation. New-Keynesians repair indeterminacy by assuming that central banks follow “equilibrium selection” policies. If inflation comes out contrary to their desires, central banks promise to drive the economy to hyperinflation or deflation, so scaring us all into choosing the inflation they like. But central banks do no such thing. They resolutely promise to stabilize the economy, not to deliberately destabilize it to choose equilibria. When inflation it 9% in 2021, despite evident wishes of central banks that inflation stay at 2%, they did not induce a hyperinflation. These are fine theories, they just don’t apply to our world any more than the gold standard does.

Enter fiscal theory, which can build on the new-Keynesian model, repairing its “indeterminacy” and restoring sensible central bank behavior in the model. Fiscal policy repairs the missing ingredient of the new-Keynesian model. If inflation were to jump up or down, that would change the value of debt. If fiscal policy does not change, the value of debt does not change, so inflation can’t jump up or down.

We have at last a complete economic theory of inflation under interest rate targets, consistent with current institutions. Even in its most simple form, the economy on its own is stable: Leave interest rates alone, and inflation will eventually settle down, just as if you leave money growth alone in the standard monetarist view, inflation eventually settles down. And the economy is determinate—the model is complete, and predicts only one value for inflation. The model is economic, not relying on people to repeatedly ignore lessons of history as a necessary ingredient in order to establish the basic questions of how prices are determined and what central banks do.

“Rational expectations” is unduly contentious, and brings up a long digression on whether people are “rational” and what that means. The question here is really about the properties of models, which are very simplified representations of the world. The issue is just, are the expectations of the model the same as the expectations in the model? Are expectations “model-consistent?” Would the people in the model change their views and become a lot better at forecasting inflation if they learned about the model? Related, the question is whether expectations in the model react to events, are expectations “reactive?” The Fed believes in “anchored” expectations. A shock hits, people see inflation, Fed models forecast additional inflation, but people don’t change their beliefs about the future, at least until things get really bad. In “rational expectations” models, when a shock hits, people change expectations right away.

Like standard monetarism, all of these models are neutral in the long-run: Higher interest rates correspond to higher inflation, and have small or no output effects, just as we thin of higher monetary growth.

Neutrality and stability seem like natural and desirable properties, but they have uncomfortable implications: If the Fed left interest rates alone, inflation would eventually settle down all on its own — just it would with a constant money growth rate. A greater challenge: Stability and neutrality imply that if the Fed raises interest rates and leaves them alone, with no change in fiscal policy, then sooner or later inflation must rise — just as higher money growth eventually produces higher inflation.

It is still possible that higher interest rates temporarily lower inflation. And “temporary” can be a long time. Blog readers and FTPL fans will know there is a nice model of such a response.

Here, the Fed raises interest rates as shown, and there is no change in fiscal policy. Inflation initially goes down, but eventually rises — as it must given the model is stable and neutral. Long term debt is the key assumption.

The paper spends a lot of time showing that other ideas you might have about how higher interest rates lower inflation don’t work. If you don’t like my little fiscal theory model, we don’t have a good model of the most basic question, how higher interest rates lower inflation, without a contemporaneous fiscal tightening. That takes a bit of time and I won’t drag you through every idea that doesn’t work.

The “without a contemporaneous fiscal tightening” is key, and one big point of the paper is to make people more aware of how important this is. Yes, there are lots of models in which higher interest rates lower inflation. But in all of them, the government also raises taxes or cuts spending. Well, once you’ve seen fiscal theory, you know how that can bring down inflation. The news is that without such contemporaneous austerity, higher interest rates don’t lower inflation at all in standard models. Intuitively, if the Fed raises interest rates, that raises interest costs on the debt. Taxes must rise or spending must fall to pay those interest costs. If not, no reduction in inflation.

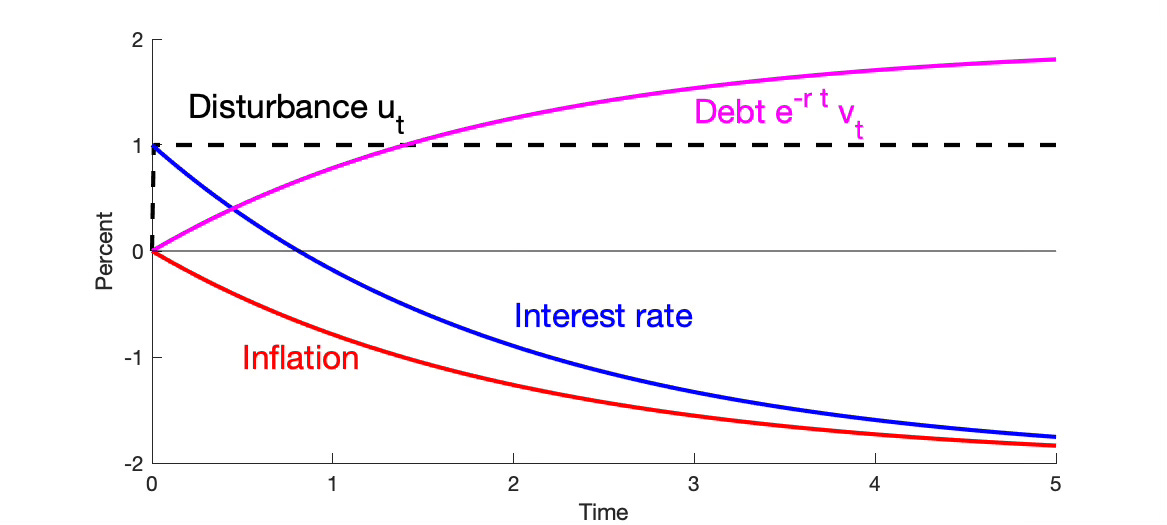

You might think sticky prices do the trick. No. With sticky prices and without long term debt or a fiscal tightening, higher interest rates raise inflation as shown above.

You might think adaptive expectations does the trick. Here is a simulation of the most standard simple adaptive expectations model:

That looks just like standard wisdom, and the standard story of the 1980s. The Fed raises interest rates, that sends inflation down, then interest rates follow inflation down. That’s the standard story of the 1980s. But interest rates greater than inflation are interest costs on the debt. Who paid those? Lower inflation means that bondholders get paid back in more valuable dollars. Who pays that? Answer: Taxpayers do. If fiscal policy does not tighten, debt grows forever, as shown. This is a joint monetary fiscal disinflation, not monetary policy alone.

The paper shows that without the fiscal tightening, higher interest rates do not lower inflation, even this storied ISLM style adaptive expectations model.

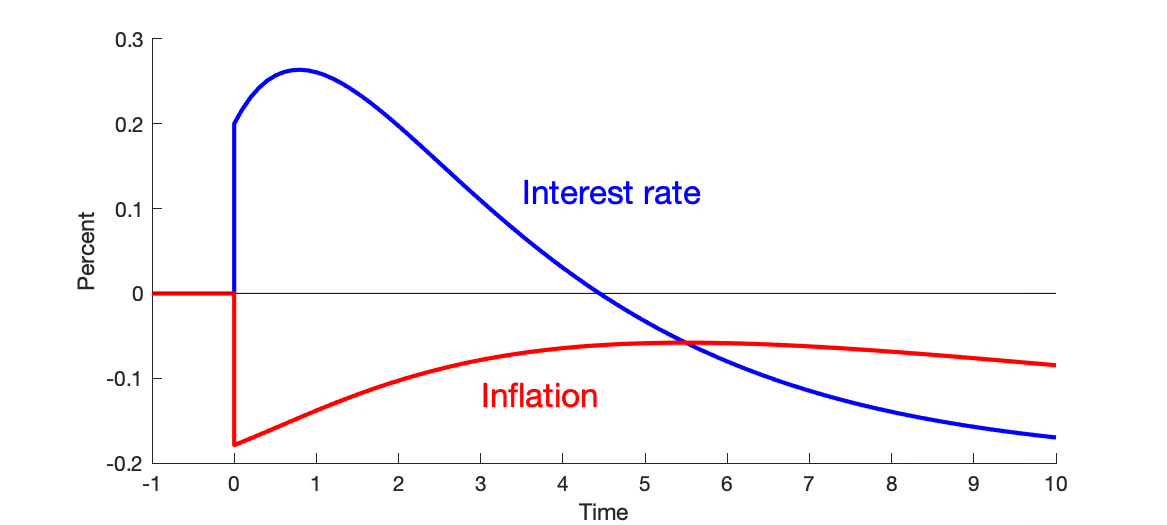

Beware. Here is another simulation, this time of the rational expectations model with sticky prices, short term debt, and no fiscal change:

Aha, you say, we have it. No. In this model inflation is a two sided moving average of the interest rate, with positive coefficients everywhere. Higher interest rates raise inflation uniformly. In this graph, the lower interests rates in the far future lower inflation at time 0-4, despite, not because of the higher interest rates in that period. I bet if the computer spit that out though, half of us might cheer and say “finally higher interest rates lower inflation!” Beware quickly reading stories into impulse-response functions.

You may want to add ingredients, and I encourage that. The paper has a nice collection of directions that you might want to go to try to get a model in which higher interest rates temporarily lower inflation, without the long-term debt fiscal theory business, and without sneaking in a fiscal tightening at the same time.

It’s hard. One of the best new parts of the paper I call “fiscal constraints.” Bit by bit I have come to a different view of what fiscal theory is all about. We traditionally start with the statement that the price level adjusts so that the real value of debt equals the expected present value of surpluses

But a few equations later the following version is far more useful. This is a response to a shock at time 0:

In words,

Inflating away long-term debt = deficits + higher interest costs on the debt.

Two special cases make it clear. phi captures the maturity structure of the debt, with debt coming due at time t equal to

Instantaneous (floating rate) debt is phi = infinity. Then, with no surplus changes since we want to know what happens when interest rates change without a change in surplus, we have only the last term.

Net interest costs on the debt must be zero.

There is no economic model here. This is just an elaboration of the fact that the value of debt must equal the present value of surpluses. This is a restriction that any model must obey. Pick a path of interest rates. The economic model tells you what inflation is. If the model has short-term debt, and no change in fiscal policy, then it must produce a path of inflation in which there is no change in these net interest costs — because there are no extra surpluses to pay for them, or long-term bondholders whose wealth can be inflated away.

You can see that for any period in which higher interest rates lower inflation, there must be a corresponding period of inflation above the interest rate. No model with short term debt can produce inflation that is always below the nominal interest rate. That’s going to be hard to do.

The long term debt limit is phi=0, a perpetuity. Now, the second term on the right disappears and only the left hand term remains. With no change in surplus,

What’s going on? With long-term debt, the government is completely insulated from changes in interest costs. It never rolls over debt, so it doesn’t ever have to refinance. But now inflation devalues long term bonds. This is the equivalent of the B/P term we started with, but much more realistic since it describes a slow inflation not a price level jump.

But with no surpluses, in this case the average inflation must be zero, no matter what interest rates do.

In both cases, all monetary policy can do is to shift inflation over time. With short term debt, a model can get only inflation below the nominal rate by producing higher inflation later. With long term debt, a model can only get inflation to go down by accepting higher inflation later. I call this “unpleasant interest rate arithmetic” in honor of Sargent and Wallace’s similar unpleasant monetarist arithmetic.

I was initially enthused about a project to find suitable complications to deliver a stronger effect. But these generic fiscal constraints mean the effort will always be limited, and end up looking like the long-term debt case at very best.

Back to the general equation, this now strikes me as a better way to say what fiscal theory is all about. Slowly inflating away long term debt = rise in primary deficits + rise in real interest costs on the debt (or, a slow windfall to long-term bond holders = rise in primary surpluses + decline in real interest costs on the debt). That’s more useful for analyzing policy and events than the original. It’s all the same of course.

Hey John, I know this is doubtlessly a silly question, but here it is anyway. How does the Fed control interest rates without controlling the money supply? Because I am not a macro economist and am not up to speed on current macro economic modeling, and because I know your math is well and truly done, I accept every word in your paper. But I did have that one question.

Central bank should set neither interest rate nor money supply targets. They should set real income-maximizing inflation rate targets, the average level of the target determined by the normal range and frequency of shocks and the degree of downward price stickiness. = AIT [Expectations affect the stickiness of prices.]

Moreover, they should be flexible enough to engineer temporarily over-target inflation to facilitate adjustment to extraordinary shocks. = FAIT