Expectations and the Neutrality of Interest Rates, Final Version

“Expectations and the Neutrality of Interest Rates” is published, Review of Economic Dynamics 53 (2024) 194–223. Until July 2 2024 you can view and download the published version for free, here. After that, visit my webpage for links. Some of the point of this post is to let people know about that free offer.

I’ve posted and tweeted about this paper a few times as it made its way through revisions. In part, I’m plugging it again here because I’m very happy with it. It’s simple, and though it reviews a lot of other research, I think you will find its conclusions novel. If you’re teaching and you want a one-stop introduction to modern macro and how it understands inflation, with a minimum of equations, this is for you. I also removed some typos, including in the equations.

A few points emerged in the final revision that are worth mention here, and may still be novel even to dedicated blog readers who have put up with several essays pitching this paper.

Grand experiments

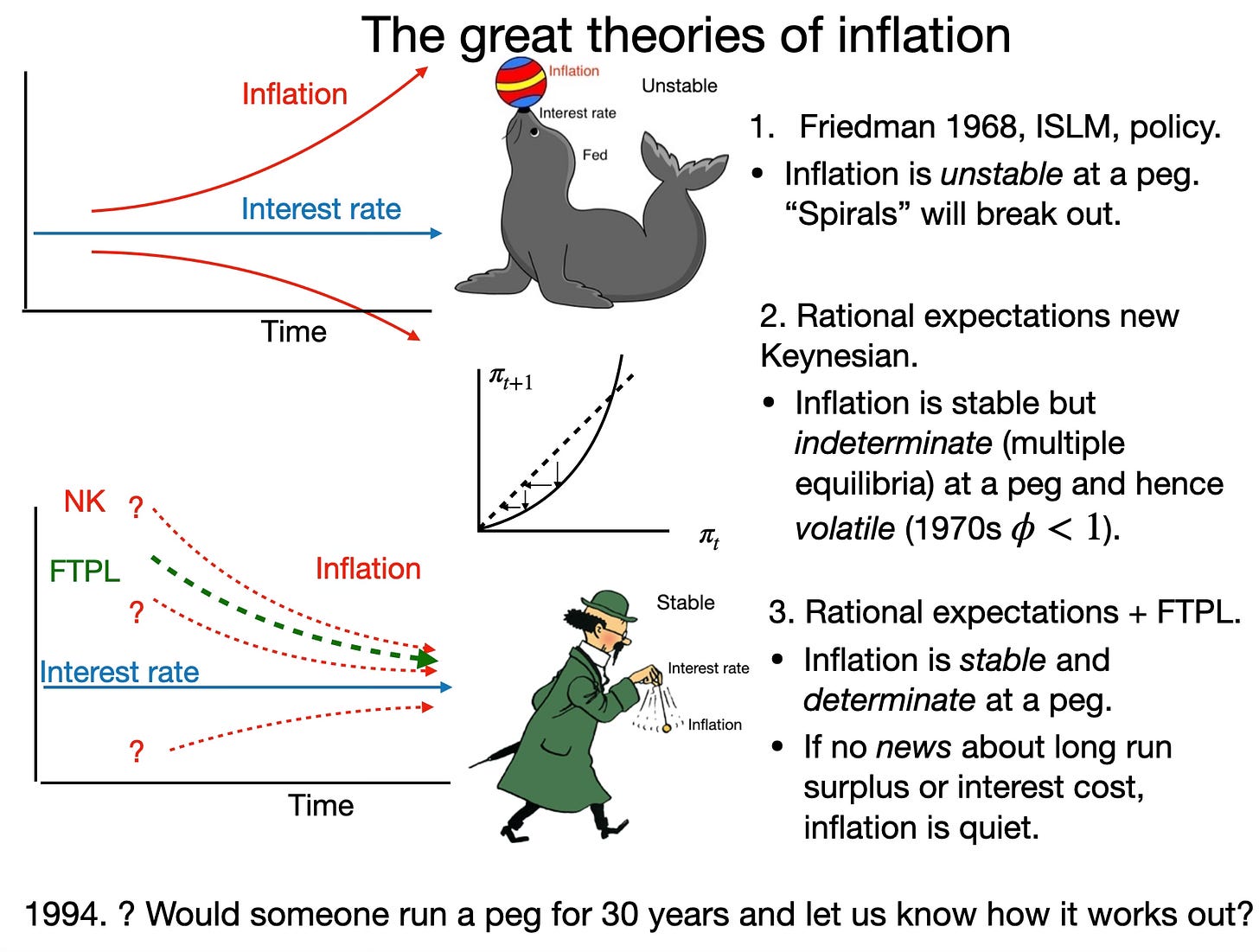

I punched up the idea that the zero bound, QE, and the post-covid inflation amount to dramatic experiments, about as clean as you can ask for in economics, to distinguish our main theories of inflation. And for a talk I’m giving in Japan, here is a nice slide:

Old-Keynesian and policy analysis states that inflation is unstable at an interest rate peg or zero bound. Inflation or deflation “spirals” will break out. A bit of deflation starts, the interest rate does not move, the real interest rate rises, that lowers aggregate demand, and produces more deflation. New-Keynesian models state that inflation is stable at an interest rate peg or zero bound, no “spirals.” But the peg or zero bound means inflation is “indeterminate.” There are multiple equilibria, and inflation becomes volatile. This is the central new-Keynesian diagnosis of the 1970s, caused by interest rates that moved but reacted less than one for one with inflation. Fiscal theory says that at the zero bound or a peg, inflation is stable and determinate, and also quiet if there is no fiscal news.

Would somebody please stick the interest rate at zero for 13 years, or maybe 30, in countries that are not having big fiscal shocks and so lowering rates as financial repression to hold down interest costs?

The US and EU just did that, and Japan provides the 30 years. There were no spirals or multiple equilibrium volatility.

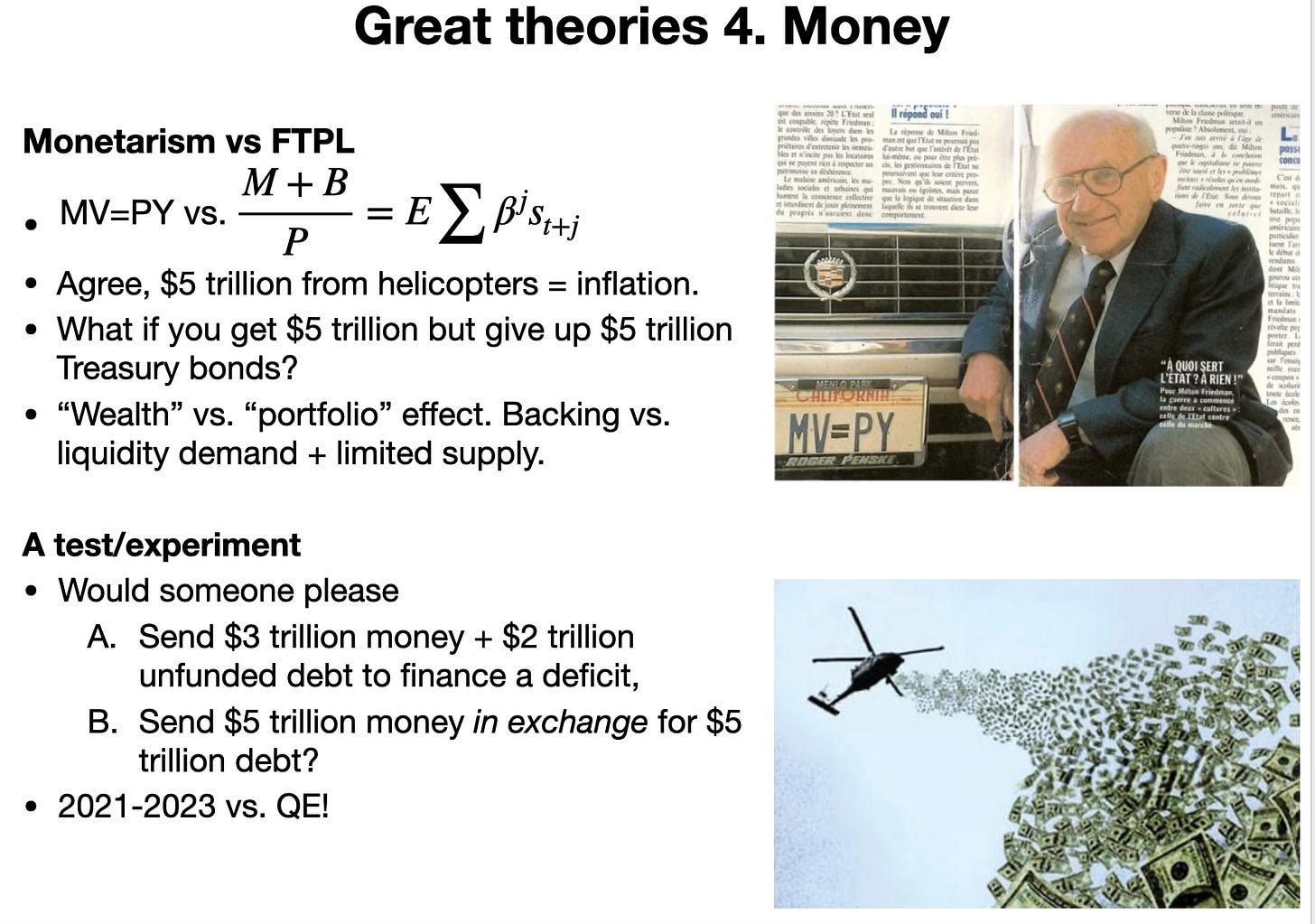

Monetarism and fiscal theory agree, if you drop $5 trillion of cash on people and they only expect that some of it will be soaked up by future surpluses of tax revenue over spending, you get inflation. The theories crucially disagree on what happens if you give people $5 trillion in cash but take back $5 trillion in treasuries, a “portfolio balance” effect with no “wealth” effect. Monetarism clearly states that this operation produces the same inflation. Only the quantity of money matters. (Implicitly, monetarism assumes that all increases in government debt are expected to be fully repaid.)

Would somebody please 1) hand out $5 trillion in cash but take back $5 trillion in Treasury debt, and then 2) hand out $5 trillion in cash and new debt, with no discussion of how it will be repaid?

Of course that is exactly what our government just did, in QE — which had no effect on inflation at all — and the covid fiscal expansion, which quickly produced a surge of inflation about half the size of the fiscal expansion (debt grew by 30%, cumulative excess inflation about 15%, so about half expected repayment). Governments around the world did the same.

These are not little diff in diff instrumental variables and 100 controls experiments. They do not concern ephemeral properties of theories that might depend on auxiliary assumptions. $5 trillion of QE vs. fiscal expansion, 13-30 years at the zero bound, are enormous experiments. They evaluate core robust predictions of each theory, relying on basic properties; stability and determinacy or the difference between open market operations and helicopter drops. We don’t see decisive experiments like this very often in macroeconomics.

The exchange rate analogy for long-run Fisherism

With the new-Keynesian + FTPL view, inflation is stable, determinate, and long-run neutral under an interest rate target. It works much like a money growth target: inflation eventually settles down to the nominal rate plus real rate, as it settles down to money growth. That prediction seems natural, but has a very uncomfortable implication that I have been wrestling with for years. If at zero rates inflation just bats around zero +/- a small real rate, then inescapably if the central bank raises the peg to 2% interest rate, inflation would eventually rise by two percentage points. It might go the other way in the short run, and the short run might last a long time, but the proposition that a perpetually higher rate means perpetually higher inflation, eventually, just flows from stability and (even approximate) neutrality.

The proposition requires solvent fiscal policy, and most failed pegs failed because the countries were having fiscal problems — and indeed were holding down interest rates to hold down interest costs. (Turkey).

Still, it’s hard to digest. It occurs to me that the situation is analogous to an exchange rate peg, which we mostly understand.

Exchange rate pegs and purchasing power parity are a good analogy. If a country wishes a lower nominal exchange rate, a less valuable currency, it can do so by pegging at that rate and waiting long enough. Any peg also requires fiscal backing, the ability to get as much foreign exchange or the will to print as much domestic currency or debt as needed to enforce the peg. Pegs fail when governments give up on these fiscal requirements. One may have to wait a very long time for purchasing power parity and a long slow inflation to kick in. Nonetheless, the proposition that an exchange rate peg is eventually neutral, that relative price levels eventually adjust, if a government can stick to that peg long enough, is intuitively clear, as are the fiscal, foreign exchange, and time-consistency limitations of that proposition for policy and historical analysis. The proposition that higher interest rates lead eventually to higher inflation is analogous. One pegs a cross-sectional nominal price and waits for real prices to return to normal. The other pegs an intertemporal nominal price and waits for real prices to return to normal. Standard intuition holds that an exchange rate peg with adequate fiscal backing is stable, just as it holds that a money growth peg with adequate fiscal backing is stable. We just extend those ideas to a nominal interest rate peg.

In sum, stability and consequent view that higher interest rates eventually raise inflation are logically linked, explainable by simple intuition, and a robust result of forward-looking expectations. They are hard to avoid.

A negative effect of interest rates on inflation?

Much of this paper is part of a long effort to find a decent model that embodies policy beliefs: that higher nominal interest rates, with some lag, bring inflation back down, all on their own i.e. without an accompanying tightening of fiscal policy. That short run negative effect is perfectly consistent with a long run positive effect.

There is no such model, at least yet. The long-term debt mechanism is the best I know of, and the paper explains both how it works and its limitations. Other than that, higher interest rates (without tighter fiscal policy) raise inflation, even in the short run. A particular difficulty is getting a model to lower future inflation, with long (if not variable) lags. Models that lower inflation at all — even with fiscal help — make inflation jump down. A good “intuition” section of the paper explains that dynamic economics does not allow you to take a model that says something happens right away and use it as a metaphor for slow adjustment.

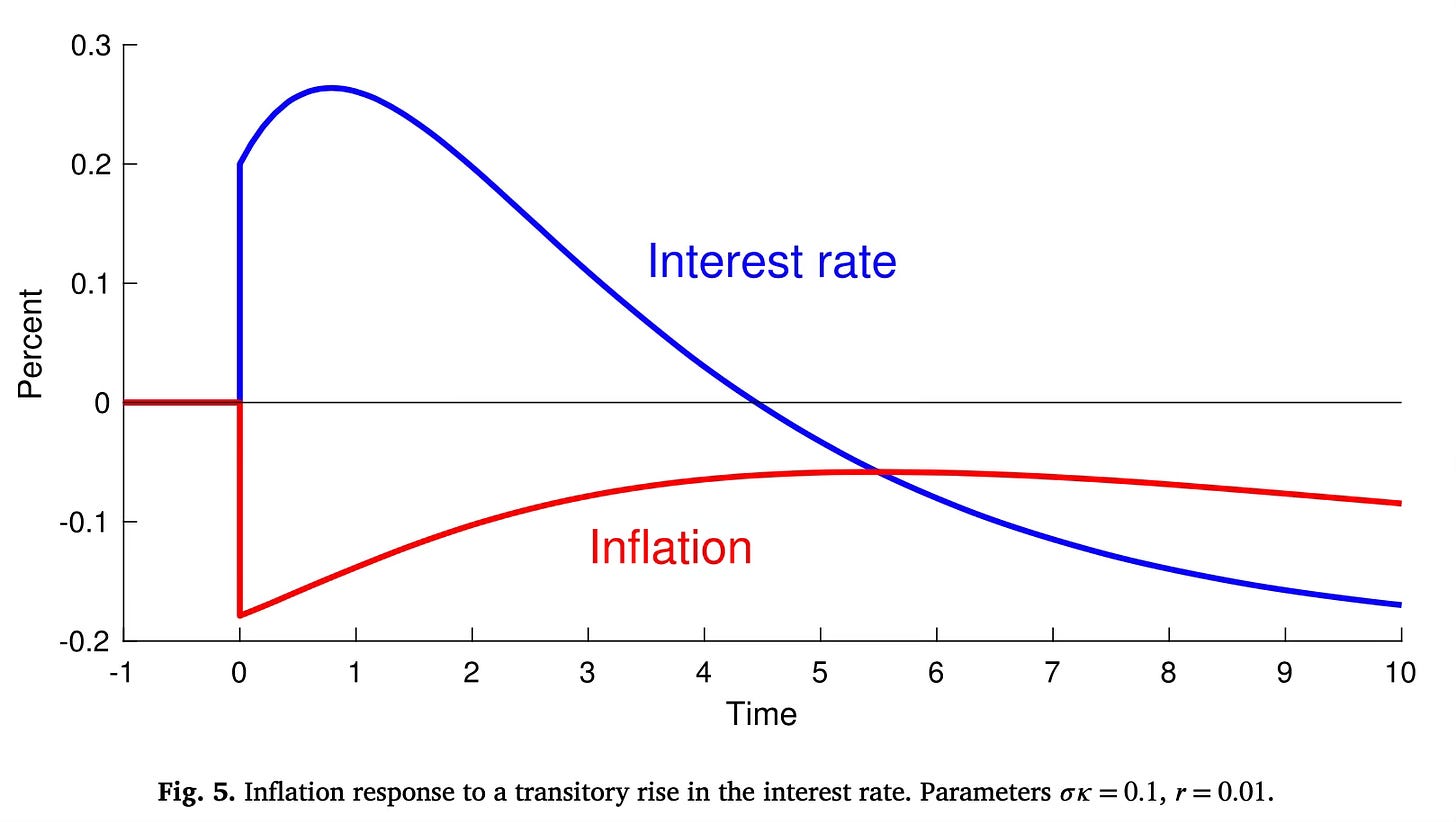

I had some fun along the way. How about this graph:

It sure looks like higher rates lower inflation, something like the 1980s, no? No. This is the rational expectations model, new-Keynesian price stickiness, and the response of inflation to the plotted interest rate path with no change in fiscal policy. The solution is

Inflation is a two-sided moving average of the nominal interest rates with positive coefficients. The response of inflation to interest rates is unambiguously positive. But the moving average smooths things out. By having interest rates decline in the long run, I move all inflation down.

… a reading that higher interest rates cause the disinflation would be profoundly misleading. Inflation declines initially because expected interest rates decline in the far future, despite, not because of, the short-term interest-rate rise. Indeed, the positive interest rates drag inflation up from even more negative values. If you want less inflation in this model, lowering interest rates immediately—the negative of Fig. 2—is an even more powerful tool. There is nothing in the mechanics of this model that resembles standard intuition, that high real interest rates drive inflation down. Beware causal readings of impulse-response functions!

I look at adaptive expectations models too. Even in adaptive expectations models, higher interest rates must come with a fiscal tightening if they are to lower inflation — fiscal policy must pay higher interest costs on the debt and a windfall to bondholders. In the standard adaptive expectations model, higher interest rates without such fiscal support do not lower inflation.

A constraint on interest rates lowering inflation

These are fun examples, but perhaps the thing that I learned most when writing the paper is an overall constraint, that makes it very hard for any model of inflation dynamics to have higher interest rates lower inflation, without contemporaneous changes in fiscal policy.

From the basic budget identities, I get to this

There is long term debt with a geometric maturity structure; debt declines with maturity at rate phi. This is linearized, and r is the steady state real rate. s tilde is surplus divided by the steady state value of debt. I also use the expectations hypothesis, so the expected return on government debt and interest cost is i - pi.

This holds for any model of inflation dynamics, connecting i and pi. It is, in the end, my new favorite expression of what fiscal theory of the price level has to say.

This equation unites the three important fiscal mechanisms. On the left, a rise in expected future inflation devalues the claims of long-term bondholders, and deflation gives them a windfall. This mechanism takes the place of a price level jump, but acts via more plausible drawn-out inflation which devalues long-term bonds as they come due. On the right, we have surpluses. Those are zero for my definition of “monetary policy.'' Finally, we have the effect of interest costs on the debt, which flow on to the government budget as debt rolls over. …

With no change in surpluses and for short term debt phi = infinity ..[it] simplifies to

\(0 = \int_{t=0}^\infty e^{-rt}(i_t-\pi_t) dt. \)With short-term debt and no price-level jumps, inflation cannot devalue outstanding debt directly. Then the long-run average of real interest rates and interest costs on the debt must be unchanged. For any model of inflation dynamics, the average weighted difference between inflation and interest rates must be zero.

For perpetual debt phi = 0 [it] simplifies to

\(\int_{t=0}^\infty e^{-rt}\pi_t dt =0.\)In this case, both government and bondholders are fully insured against changes in real interest rates, as neither has to roll over existing debt. With long-term debt, however, inflation devalues long-term nominal promises, and deflation delivers a windfall to bondholders. Thus, with no change in surpluses, the long-term average of inflation itself must be unchanged.

In these expressions, and the intermediate cases in between, unpleasant interest-rate arithmetic is generic. Any model in which higher interest rates lower short-run inflation must produce higher subsequent inflation. Monetary policy is limited to moving inflation around through time, lower at some time in return for higher at another time.

With short-term debt …, inflation averages zero around the nominal interest rate path. With long-term debt …, inflation itself averages zero around zero response, which makes it a little easier to get lower inflation in the short run in return for more inflation later, …. But no model can produce uniformly negative inflation from higher nominal interest rates.

The paper is more questions than answers. We really do not have a satisfactory model of how higher interest rates lower inflation, at least one that is vaguely close to standard policy beliefs. Maybe those beliefs are wrong. We don’t have good empirical evidence either (the paper goes on about that.) Macro may seem an endeavor devoted to refining ever more complex extensions of a well accepted and workable new-Keynesian structure, but it is not. Basic questions lie unanswered, elephants in the room.

Lucas

This paper started as a talk I gave at the Minneapolis Fed conference commemorating the 50th anniversary of Lucas’ “Expectations and the neutrality of money.” My theme is, central banks don’t set money supplies, they set interest rates, and we need to follow Lucas but with that substitution. The paper is about how far we have gotten in that program and a bit of where to go.

In the time since the conference, Lucas has sadly passed away. This paper is also a bit an offering in his memory. He was kind, gracious and very helpful to me as a young assistant professor at Chicago. Lucas would probably have hated this paper. I left out all the proper general equilibrium specification that Lucas always insisted on. He was also a dyed in the wool monetarist. But I hope Lucas might have appreciated the framing of the question, and my insistence as his, to take economics seriously and to match big picture predictions to data.

I recall when he was writing his Nobel prize speech he had a sentence in it, something like “It goes without saying that the central bank can and should control the supply of money.” I objected, then as now, that central banks set interest rates, do not control money supply, and we had better get going on a theory consistent with that fact. I don’t recall if he changed it, but the point of the story is also to remember a man, a time, and a department, in which Nobel prize winners of Lucas’ stature sent their papers to raw assistant professors, the latter gave upstart critical comments, and the former at least thought hard about them. I will profoundly miss him, and that time.

Great paper, and a great demonstration of the importance of getting to the (seemingly only) technical details of models, as they may hide deep economic insights.

And on technicalities… I am puzzled by the long-run non-neutrality of the model (equation 30 in the paper).

My understanding is that the FTPL addition to the NK model does nothing to the steady-state. The FTPL addition determines the equilibrium path outside the steady-state, but does not affect it, so the model must share the same steady-state as the standard NK model.

In its simplest form, the NK model displays long-run non-neutrality due to price dispersion across producers, which leads to inefficient production. Zero steady-state inflation eliminates the price dispersion in the long-run and the inefficiency. This type of non-neutrality is easy to fix by assuming full price indexation to steady-state inflation, i.e. producers that cannot re-optimize in period t automatically adjust their price by the rate of steady-state inflation.

However, equation 30 is derived from a linearized version of the model. Price dispersion is second-order. Therefore, the non-neutrality displayed by equation 30 cannot possibly come from price dispersion. Where does it come from? Is it really a property of the *exact* model, or is it an artifact of using its linear version?

"Old-Keynesian and policy analysis states that inflation is unstable at an interest rate peg or zero bound. Inflation or deflation “spirals” will break out."

This idea is older than the Old Keynesians: it was expressed by Wicksell. He would have added an important qualifier that you omitted: inflation is unstable at an interest rate peg or zero bound *if that rate differs substantially from the natural rate of interest.*

Evidently the central bank rate at close to zero was not too far from the natural rate in United States, the euro area, and Japan after the Great Recession. Such is not the case at most places and times.

To this Wicksellian, you seem to be making the old mistake of thinking of the interest rate as the price of money rather than as the rental price of money.